Family Legacy & Relationships with Money

Uncover How Early Influences Shape Your Financial Perspectives and Behaviors

Family Legacy & Relationships with Money

Uncover How Early Influences Shape Your Financial Perspectives and Behaviors

In working towards an understanding and an appreciation for our own relationship with money, we need first to understand the messages we received around money in our formative years and how we chose (unconsciously or consciously) to internalize these either emotionally, intuitively, or intellectually. Family legacy plays a crucial role here: the inheritance of worldviews from our parents and caregivers significantly shapes our early perspectives on money. This early worldview will determine how, as adults, we approach money and wealth through one of three centers of expression: as a means to gain independence or autonomy; as a way to feel connected and build secure relationships; or as a way to ensure safety and security against a complex and demanding world. Join us as we go one layer deeper into the Enneagram and explore the 3 Centres of Expression.

Here’s what you’ll learn by attending:

Gain insights into how early life experiences influence your financial behavior.

Learn about the three centers of expression and how they shape your relationship with money.

Enhance your financial well-being by understanding your unique approach to money management.

Karin Wellman

Organisational Performance Coach

Caleo Capital

Scott Picken

Your Host

Family Legacy & Relationships with Money

Watch the recording

Tuesday, 11th June 2024

6pm UK | 7pm SAST

*Registration Required. Please check your email for your unique Zoom join link. Show up early as attendance will be limited.

In working towards an understanding and an appreciation for our own relationship with money, we need first to understand the messages we received around money in our formative years and how we chose (unconsciously or consciously) to internalize these either emotionally, intuitively, or intellectually. Family legacy plays a crucial role here: the inheritance of worldviews from our parents and caregivers significantly shapes our early perspectives on money. This early worldview will determine how, as adults, we approach money and wealth through one of three centers of expression: as a means to gain independence or autonomy; as a way to feel connected and build secure relationships; or as a way to ensure safety and security against a complex and demanding world. Join us as we go one layer deeper into the Enneagram and explore the 3 Centres of Expression.

Here’s what you’ll learn by attending:

Gain insights into how early life experiences influence your financial behavior.

Learn about the three centers of expression and how they shape your relationship with money.

Enhance your financial well-being by understanding your unique approach to money management.

Special Guest:

Karin Wellman

Organisational Performance Coach

Caleo Consulting

As a certified Master Coach specialising in Business and Executive coaching, my focus goes beyond the norm, with a special interest in leadership transitions, and helping individuals develop their leadership capabilities for navigating change and uncertainty.

My coaching aims to guide individuals and organisations to reach their full potential, fostering a collaborative culture for tangible improvements in both individual and team performance.

Alongside coaching, I'm a certified Enneagram practitioner and a Team and Personal Resilience Coach. My commitment extends to creating a heightened awareness of motivations behind behaviour, with a special focus on the link between the Enneagram and Wealth, empowering individuals to achieve financial wellbeing through psychological understanding.

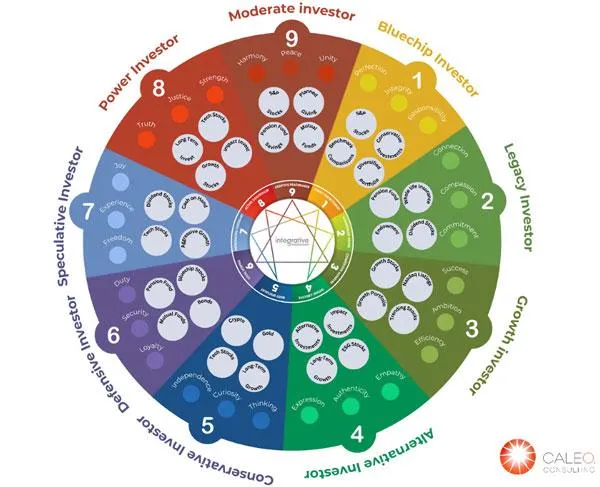

The Enneagram of Wealth

Overview of each Enneagram type's tendencies and attitudes towards wealth:

Type 1 – The Strict Perfectionist

Tend to be disciplined savers, prioritising financial responsibility and prudence.

Type 2 – The Considerate Helper

Generous with their resources, often prioritising the needs of others over their own financial well-being.

Type 3 – The Competitive Achiever

View wealth as a measure of success and may pursue financial goals with ambition and determination.

Type 4 – The Intense Creative

Seek unique and creative approaches to wealth accumulation, often valuing experiences over material possessions.

Type 5 – The Quiet Specialist

Approach wealth with analytical precision, conducting thorough research and planning before making financial decisions.

Type 6 – The Loyal Sceptic

Seek security and stability in their financial affairs, often prioritising saving and risk aversion.

Type 7 – The Enthusiastic Visionary

Approach wealth with a sense of optimism and abundance, enjoying the freedom that financial resources can provide.

Type 8 – The Active Controller

View wealth as a means of empowerment and may pursue financial success with confidence and assertiveness.

Type 9 – The Adaptive Peacemaker

Value financial harmony and may prioritize avoiding conflicts over asserting personal goals.

What Participants are saying about this Masterclass

Copyright 2025 - Wealth University